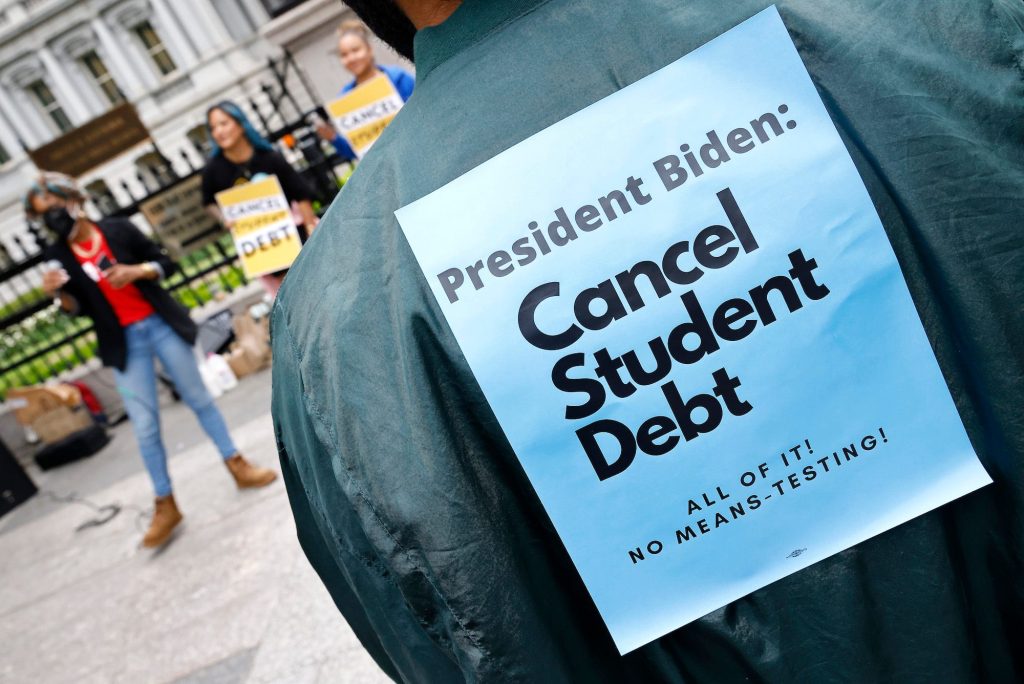

The Biden loan forgiveness plan and who it’s meant to help

President Biden announced a plan to forgive up to $20,000 in student debt, but what does that mean for current students, and who qualifies?

On August 24, President Biden announced a three part plan that would aid individuals who have student loan debt. This plan includes forgiving up to $20,000 in student loans, but who qualifies for this aid?

This plan is designed to help middle and low income households. Individuals who make less than $125,000, and those in households that make less than $250,000 can qualify for $10,000 in federal loan forgiveness. Individuals who have received Pell Grants can qualify for an additional $10,000 in student loan forgiveness.

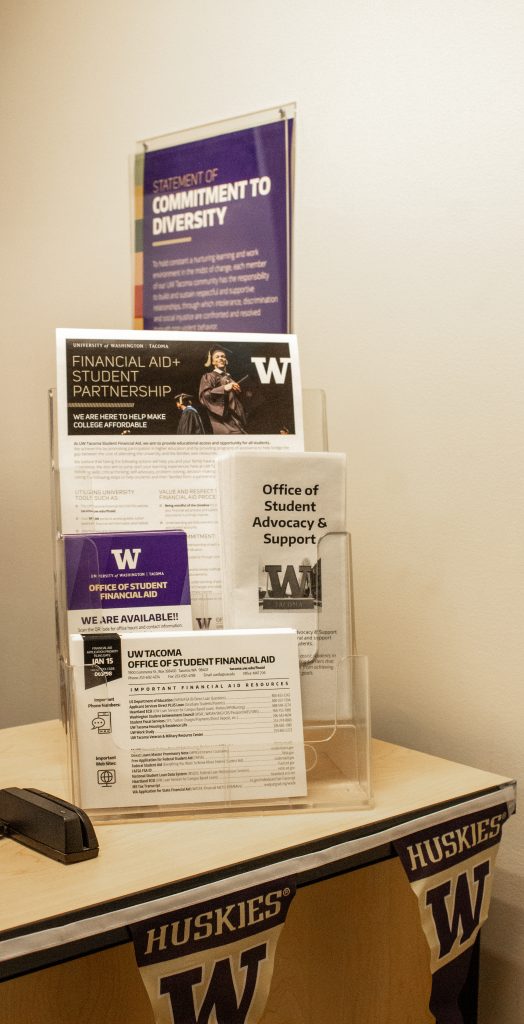

What is a Pell Grant? According to the Federal Student Aid Website, Pell Grants are given to undergraduate students who “display exceptional financial need and have not earned a bachelor’s, graduate, or professional degree.” The Office of Student Financial Aid and Scholarships states that 57% of students attending The University of Washington Tacoma receive Pell Grants.

This can be a relief for students who have accrued loans, but leaves some wondering what has taken the administration so long to enact a plan. Originally, while on the campaign trail in 2020, Biden backed some fellow politicians’ plans to cancel or wipe out some student debt. While Biden backed some of these ideas, he never specifically agreed to more progressive figures such as wiping out all student debt or even $50,000. He has stated in the past his desire to cancel $10,000 in federal student loans.

For some students such as Mia Robbins, a junior studying Biomedical Sciences, this information can be a little underwhelming. “I guess it’s a little disappointing, a lot of students have a lot more than $10,000 of student debt,” Robbins said.

There still are a lot of questions students may have, such as if they are a dependent or current student, will they qualify for this aid? Luckily, the answer is yes, but it can be confusing to locate this information or even know when to take the next steps to receive this aid.

Students like Robbins believe that it could be beneficial for schools to help their students locate information that could help them understand this loan forgiveness process. “I feel it would be helpful for a lot of students because a lot of students like me know nothing to very little about what is going on with this loan forgiveness plan,” Robbins said.

The main appeal of this plan is the student loan forgiveness, but loan borrowers can also expect a longer halt to their repayments and as of now, will not have to make a payment until January of 2023. There are also plans towards making repayments more manageable with repayments towards loans only being 5% of an individual’s income vs. the standard 10%.

Along with this, includes a plan to forgive loans after 10 years for individuals who owe $12,000 or less and have made payments for the past 10 years, which used to be forgiven after 20 years. Nearly 8 million people can expect to be automatically enrolled to receive this aid relief but when students can expect to see this relief is unclear. For more information and facts, you can visit: https://studentaid.gov/debt-relief-announcement/