Initialtives Recap

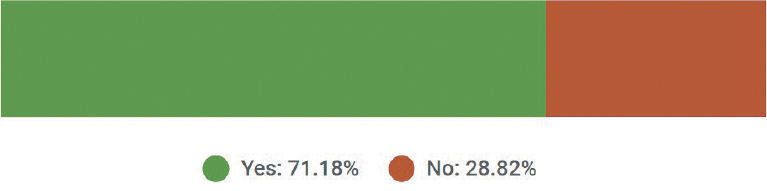

Initiative Measure No. 1491:

Court-issued extreme risk protection orders

This initiative would create two new types of court orders in addition to existing civil protection orders. The first order — the “extreme risk protection order” — would allow family members, roommates, significant others and law enforcement agencies to petition a superior court that a respondent’s access to firearms be revoked for one year. All petitions require a statement of facts under oath demonstrating that a respondent has shown a reasonable likelihood of committing violence against oneself or others. A respondent can request a hearing to demonstrate that the order is not warranted.

The second type of court order — an “ex parte extreme risk protection order” — is more immediate and reserved for those who pose a significant risk to themselves. If invoked, the petitioned court must hold a hearing on the same or following business day and does not need to notify the respondent. This type of order would only be valid until a hearing for the year-long extreme risk protection order was held and the petition confirmed.

The measure makes it illegal to file an intentionally harassing petition or to violate the terms of the court order.

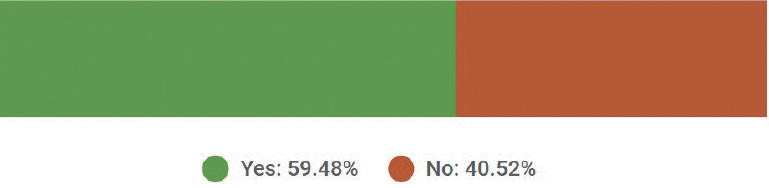

Initiative Measure No. 732:

Carbon emission tax

This initiative would create a new tax on using or selling fossil fuels. The first person or company to sell or burn fossil fuel would pay a $15 tax per metric ton for the first year. The tax would increase incrementally until it reached $100 per metric ton, adjusted for inflation. Fuels used for agricultural, public or nonprofit transportation services, ferry service and school buses would be taxed at five percent the normal rate during the first year, 10 percent during the second and then incrementally higher until 2055, when all uses would be taxed the same.

In addition, the state sales tax (currently 6.5 percent) would be reduced to six percent in 2017, and reduced again to 5.5 percent in 2018. The business and occupation tax for manufacturing would be reduced to 0.001 percent.

Families that qualify for the federal earned income tax credit would be eligible to receive a partial refund of the state sales tax they paid for the year. In 2017 and 2018, eligible families can receive 15 and 25 percent, respectively, of the earned income credit or $100 — whichever is larger.

Initiative Measure No. 735:

Constitutional rights belong only to individuals

This initiative urges current and future Washington state members of Congress to propose a federal amendment to the Constitution that would limit political financial contributions to individuals only. Amendments to the federal Constitution can be proposed by Congress or by a constitutional convention. Two-thirds of all state legislatures must call for a constitutional convention for it to be convened. If a federal amendment is proposed, it must be ratified by three-fourths of all states.

This initiative would require that the Secretary of State deliver copies of the initiative to the Washington State Governor, all members of the Washington State Legislature, all members of Congress and the President.

Initiative Measure No. 1433:

Concerns labor standards

From January 2017 onwards, the minimum wage would increase in gradual increments and by 2020, it would be $13.50 per hour. Beginning January 2018, employers would be required to provide paid sick leave to employees covered by the Minimum Wage Act and by January 2021 the rate would adjust each year per the rate of inflation. Employers would be required to provide employees with paid sick leave to care for the health of themselves and their families. An employee would get at least one hour of paid sick leave for every 40 hours worked with the employees having the ability to carry over up to 40 hours the following year. The city of Tacoma already has an ordinance that grants employees paid leave. The expenditure impact of the initiative on local governments is indeterminate.

Initiative Measure No. 1464:

Concerns campaign finance laws and lobbyists

This measure would make several changes to the laws governing elections and lobbying. I-1464 would create a campaign-finance system, allow residents to direct state funds to candidates, repeal the non-resident sales-tax exemption, restrict lobbying employment by certain former public employees and add enforcement requirements.

A new program which registered voters and certain other eligible Washington residents could make donations to campaigns for certain elected offices by using public funds. The law would call such donations “democracy credit contributions.”

Democracy credit contributions would come from state funds. This measure would repeal the nonresident sales tax exemption and require nonresidents to pay the sales tax on retail purchases in the state.

Initiative Measure No. 1501:

Citizen’s initiative

This act — also known as the seniors and vulnerable individuals’ safety and financial crimes prevention act — would increase the penalties for criminal identity theft and civil consumer fraud targeted at seniors or vulnerable individuals.

This measure would change criminal and civil laws that apply when these vulnerable individuals or seniors are targets of identity theft or consumer fraud. Any person who commits consumer fraud that targets such individuals would be subject to civil penalties of three times the amount of actual damages.

The measure would change the Public Records act to prohibit disclosing “sensitive personal information” of both vulnerable individuals and “in-home caregivers of vulnerable populations.” The measure defines sensitive information to include names, addresses, GPS coordinates, telephone numbers, email addresses, social security numbers, driver’s licenses numbers or other personal identifying information.

Also, with this measure, the Department of Social and Health Services would be required to report to the Governor and Attorney General about any additional records that should be made exempt from public disclosure to protect seniors and vulnerable individuals from victimization.

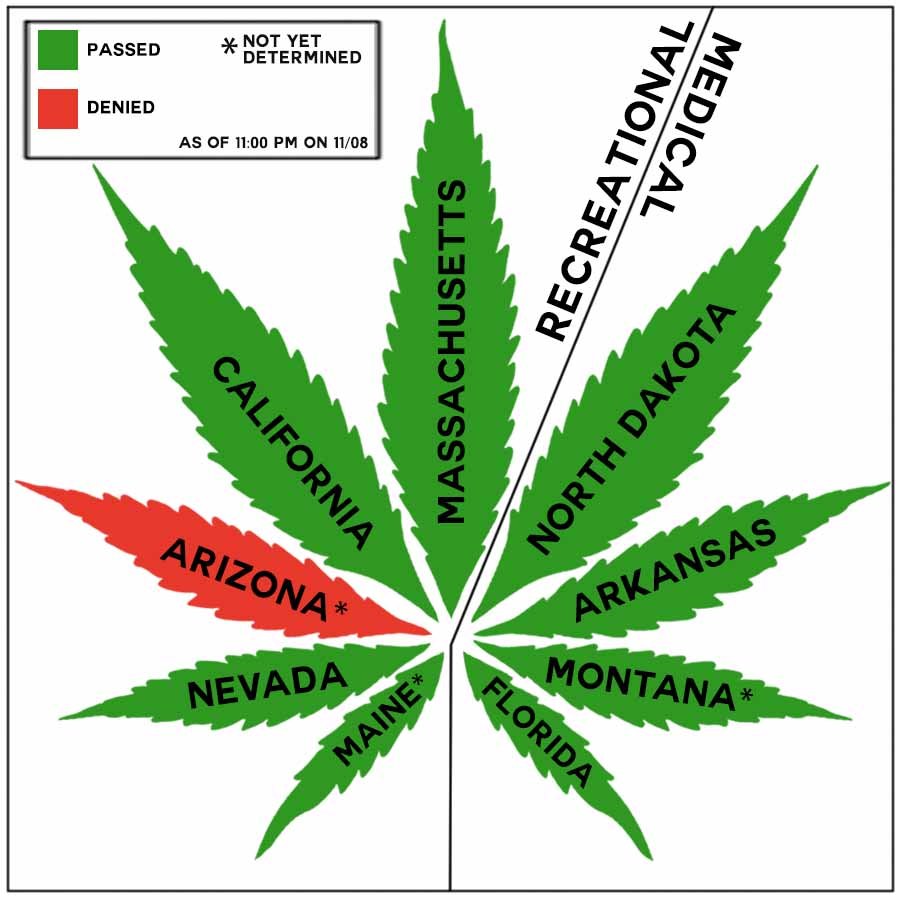

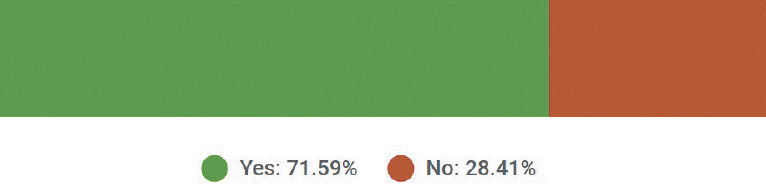

Marijuana usage by state