Upward Economic Mobility

America loves a good rags to riches story. From orphan Annie to Oprah, we believe that if you work hard enough, you can make it—you can have “the American Dream.” However, a 2013 report by Pew Charitable Trusts reveals that only 4% of Americans raised in the bottom income quintile move to the top quintile as adults, while 70% remain below the middle. This phenomenon, where top earners and low earners are more likely to remain in their respective brackets, is called “stickiness at the ends.” It begs the question, what is it about the way wealthy people spend money that allows them to retain their wealth? What is it about the way poor people spend money that keeps them at the bottom of the socio-economic scale? Is it the amount of money made by the individual or is it the individual’s money mindset?

The ability to move between economic classes is called “economic mobility.” The aforementioned Pew Charitable Trust study revealed that economic mobility is greatest in the middle class. “Middle class” doesn’t have an official definition, but the Pew study defined it as “households that earn between 67% and 200% of a state’s median income.” In the State of Washington the median household income is $58,405. This means that households earning between $38,937 and $116,810 may be considered middle class. Students graduating in the spring will be happy to know that last year, “students who graduated from college… earned median starting salaries of $45,478,” according to the National Association of Colleges and Employers. The good news is that as a college graduate, you are more likely to be in the middle or upper class; however, being in the middle class, you are just as likely to move to the top as you are to the bottom. It is a dangerous pickle!

Researchers found that a healthy savings account balance and wealth building assets, such as stocks, contribute to upward mobility. As do education, continual employment, and being in a dual earning household. All of these things contribute to your accumulation of riches. Contrarily, where riches are quantified by dollar signs, wealth is quantified in terms of time. Consider this: if you stopped working today, how long could you continue to live at your current level of consumption? The answer to that question is a measure of your wealth. Most things we buy—books, music, cars, dinner out, computers, etc. are consumer goods. They depreciate in value fairly quickly. Wealth is accumulated by purchasing things that appreciate in value and cannot be consumed. For example, gold bullion and real estate properties usually appreciate in value and cannot be consumed. Accumulating money will help you to cover the basics, but in order to ascend the economic ladder and stave off falling into the sticky pits, you’ll need to accumulate wealth: the total value of all tangible and intangible assets subtracted by all debts. In the words of the poet Lauryn Hill, “It’s not about what you [make], it’s about what you keep.”

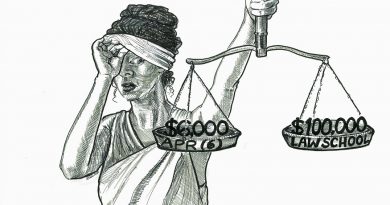

The road to financial struggles often begins after high school graduation. Many students go into debt obtaining college degrees and need jobs to pay back the debt. In the process of acquiring jobs, many will choose to finance a personal vehicle. Most people eventually settle down—get into relationships, have children, finance homes—and continue working to pay for it all. Large amounts of debt compounded with life events doesn’t necessarily paint you poor, but it’s a good primer.

Poor people don’t stay poor simply due to frivolous spending. Poverty is fostered when a culture necessitates a set of basic needs that exceeds the average person’s ability to acquire those needs without borrowing money. While the building blocks of wealth are expensive and yield minimal immediate gains (you can’t eat stocks), they are crucial to escaping the rat race. Unfortunately, that is a lesson that many of us will not learn until long after graduation. Schools can teach us to get jobs and earn money, but we have to educate ourselves on how to spend it.