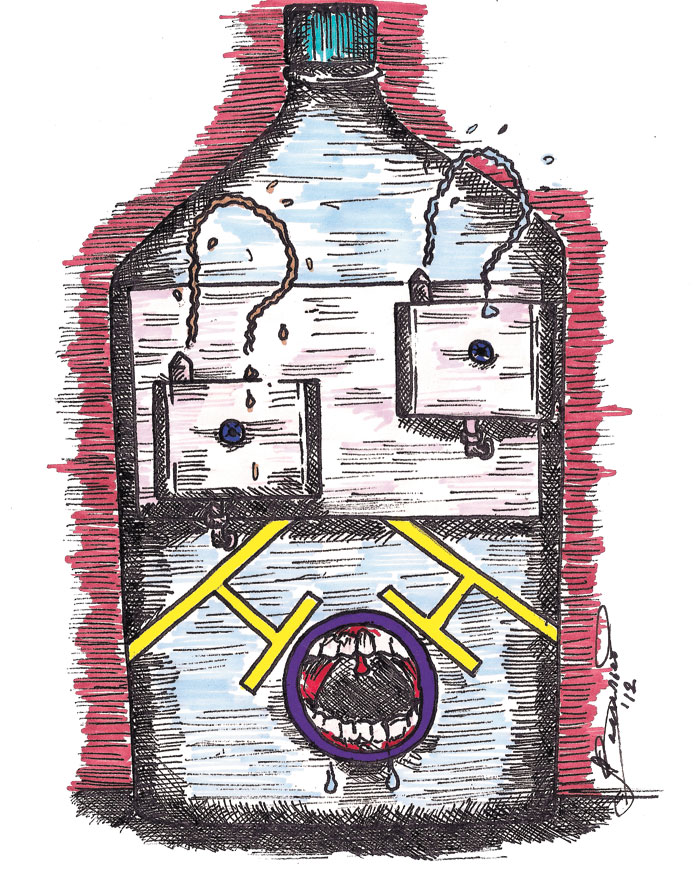

Predatory student lending

Student loan debt has reached epidemic proportions in the USA. Surpassing credit card debt, it amounts to around a trillion dollars now and is likely to grow as tuition prices continue their rocket ride higher and higher.

Truth-in-Lending laws have been stripped away from these arguably most-vulnerable US “consumers.” Professional license revocation and co-signer liability are among the most worrisome penalties for non-payment.

Many UWT students will accept the loans offered to them without ever knowing the full breadth of their commitments. Aren’t young, first-time borrowers the very ones who are most in need of such citizen protections? To learn more visit the Consumer Financial Protection Bureau atwww.consumerfinance.gov/

Another big advantage that “predatory student lenders” won, no doubt after some expensive and extensive lobbying in DC, was to remove bankruptcy protection from student loans, a nasty sell-out indeed. You might want to write to the nearest responsible elected representative about stopping this particular assault against the “educated citizenry” who are the backbone of any functioning democracy.

Corporate financial “errors” can be absolved through bankruptcy court or with the much more popular taxpayer-funded “bail-out.” So too can any otherfinancially-challenged US citizen who may have had problems and been forced to default on loan and interest payments find relief in bankruptcy court.

Due in part to our global economy and “outsourcing-friendly” legislation from DC, family-wage jobs have become very difficult to find and hold in the USA. Our students are competing with students from the many other nations where education and healthcare are considered basic human rights. These so called “commodities” are available for many of these other competing global students at no cost.

It is now common for a US graduate to have amassed $50,000 in debt before ever being hired into their first entry-level position. These indentured students will likely be paying off the educational debts for many years excluding them from the ability to purchase their first home, thus taking away another big piece of the now-mythical “American Dream.”

Please, read and understand every word on every page of any legal document that you sign, no matter how long it takes or how impatient the loan service person may become. After all, it is not their future prosperity that is on the line, is it? Their job includes explaining in plain English exactly what it is that they are offering you to sign. This is especially important with loans that are exempt from Truth-in-Lending regulations and other standard citizenprotections such as the ability to file for bankruptcy.

Our “electeds” have been entrusted with the power to stop such madness but will evidently not act without first hearing public outcry. Silence is affirmation. Make your voice heard if you do not agree.